springfield mo city sales tax rate

Missouri Department of Revenue 2020 View sales tax rates in other Missouri cities Springfield Property Tax per 100 of assessed valuation Total 55499 City of Springfield 06129 Springfield-Greene County Library 02413 Ozarks Technical Community College 01990 Greene County. Rates include state county and city taxes.

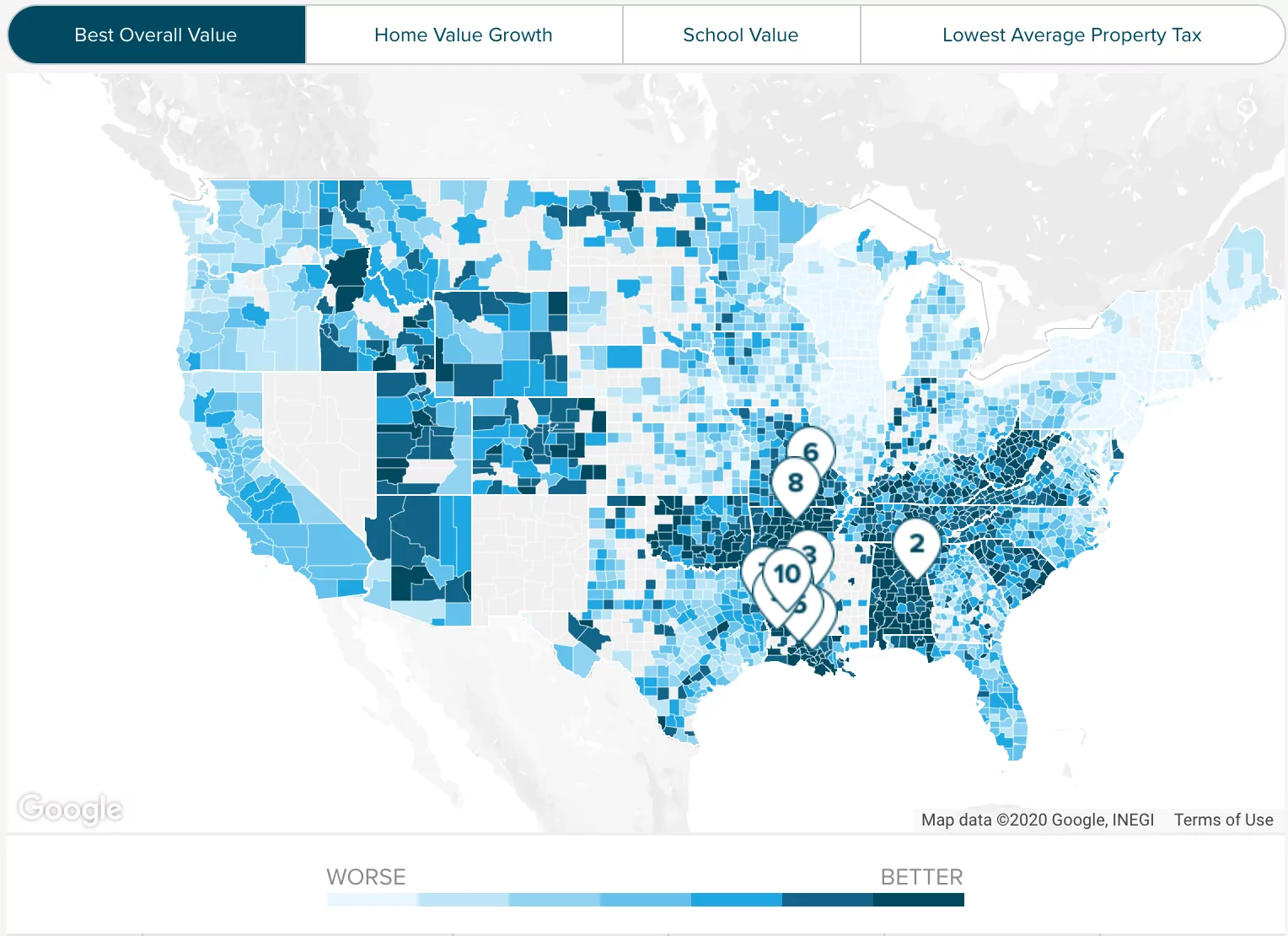

Harris County Tx Property Tax Calculator Smartasset

Contribution to a City-County jail expansion if a County sales tax passes.

. The Missouri sales tax rate is currently. Within Springfield there are around 15 zip. For tax rates in other cities see Missouri sales taxes by city and county.

Springfield collects a 3375 local sales tax the. Ad Automate Standardize Taxability on Sales and Purchase Transactions. The tax continues to be 27 cents for 100 of assessed value.

Ad Avalara can help you with global item classification tax calculation filing and more. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax. Indicates required field.

Springfield Sales Tax Rates for 2022. The County sales tax rate is. Police Fire or EMS dispatch.

The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts paid by transient guests for sleeping accommodations. The average cumulative sales tax rate in Springfield Missouri is 782. Select a year for the tax rates you need.

The City of Springfield will consider the establishment of Community Improvement Districts to finance public improvements andor public services that will directly benefit the property owners. Springfield Property Tax per 100 of assessed valuation Total 55475 City of Springfield 06218 Springfield. Sales Tax - may be imposed in 18 0125 increments up to a maximum of 1 if approved by majority vote of qualified voters in the district.

The minimum combined 2022 sales tax rate for Springfield Missouri is. 17 rows City Sales Tax City County and State taxes Knoxville TN. Create an Account - Increase your productivity customize your experience and engage in information you care about.

The projects have been completed as promised and with no increase in the tax rate. Springfield Sales Tax Springfields sales tax is 81 which includes the following breakdown. You can print a 81 sales tax table here.

Find Sales and Use Tax Rates. City of Springfield Busch Municipal Building 840 Boonville Avenue Springfield MO 65802 Phone. 15 lower than the maximum sales tax in MO.

417-864-1000 Email Us Emergency Numbers. This is the total of state county and city sales tax rates. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

Since the tax is on the hotel motel or tourist court and. Statewide salesuse tax rates for the period beginning August 2022. What is the sales tax rate in the City of Springfield.

There are a total of 741 local tax jurisdictions across. Springfield is located within Greene County Missouri. Springfield MO 65802 Phone.

Review the sales tax benchmarks. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax. 082022 - 092022 - PDF.

SalesUse Tax Rate Tables. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. There is no applicable special tax.

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. 2022 SalesUse Tax Rate Tables. The Springfield sales tax rate is.

The base sales tax rate is 81. Are room rentals to sales tax exempt customers exempt from hotelmotel tax. Springfield Sales Tax Total 8100 State 4225 County 1750 City 2125 Source.

What is the sales tax rate in Springfield Missouri. The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield. Did South Dakota v.

Make international tax compliance simpler through automation with Avalara. The latest sales tax rates for cities in Missouri MO state. Police Fire or EMS dispatch.

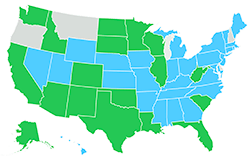

Integrate Vertex seamlessly to the systems you already use. Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337. 2022 List of Missouri Local Sales Tax Rates.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. Average Sales Tax With Local. You can find more tax rates and allowances for Springfield and Missouri in the 2022 Missouri Tax Tables.

This includes the rates on the state county city and special levels. 417-864-1000 Email Us Emergency Numbers. Missouri Department of Revenue 2018 For a comparison of sales tax rates in other Missouri counties click here.

Enter your street address and city or zip code to view the sales and use tax rate information for your address. 2020 rates included for use while preparing your income tax deduction. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

Hickory County Looking To Impose A 911 Sales Tax Causes Confusion With Residents

Highest Gas Tax In The U S By State 2022 Statista

Missouri Car Sales Tax Calculator

Louisiana Sales Tax Rates By City County 2022

Missouri Sales Tax Guide For Businesses

Missouri Income Tax Rate And Brackets H R Block

Sales Tax On Grocery Items Taxjar

Highest Gas Tax In The U S By State 2022 Statista

Taxes Springfield Regional Economic Partnership

The Sarpy County Nebraska Local Sales Tax Rate Is A Minimum Of 5 5

Use Tax Web Page City Of Columbia Missouri

Missouri Sales Tax Rates By City County 2022

Michigan Sales Tax Guide For Businesses